OpenAI Lays Out Eye-Watering Spending Plan

OpenAI now expects to burn $115 billion by 2029—four times its earlier estimate—as rising compute, talent, and infrastructure costs outstrip even its booming ChatGPT revenue and new $500 billion valuation

What’s Happening

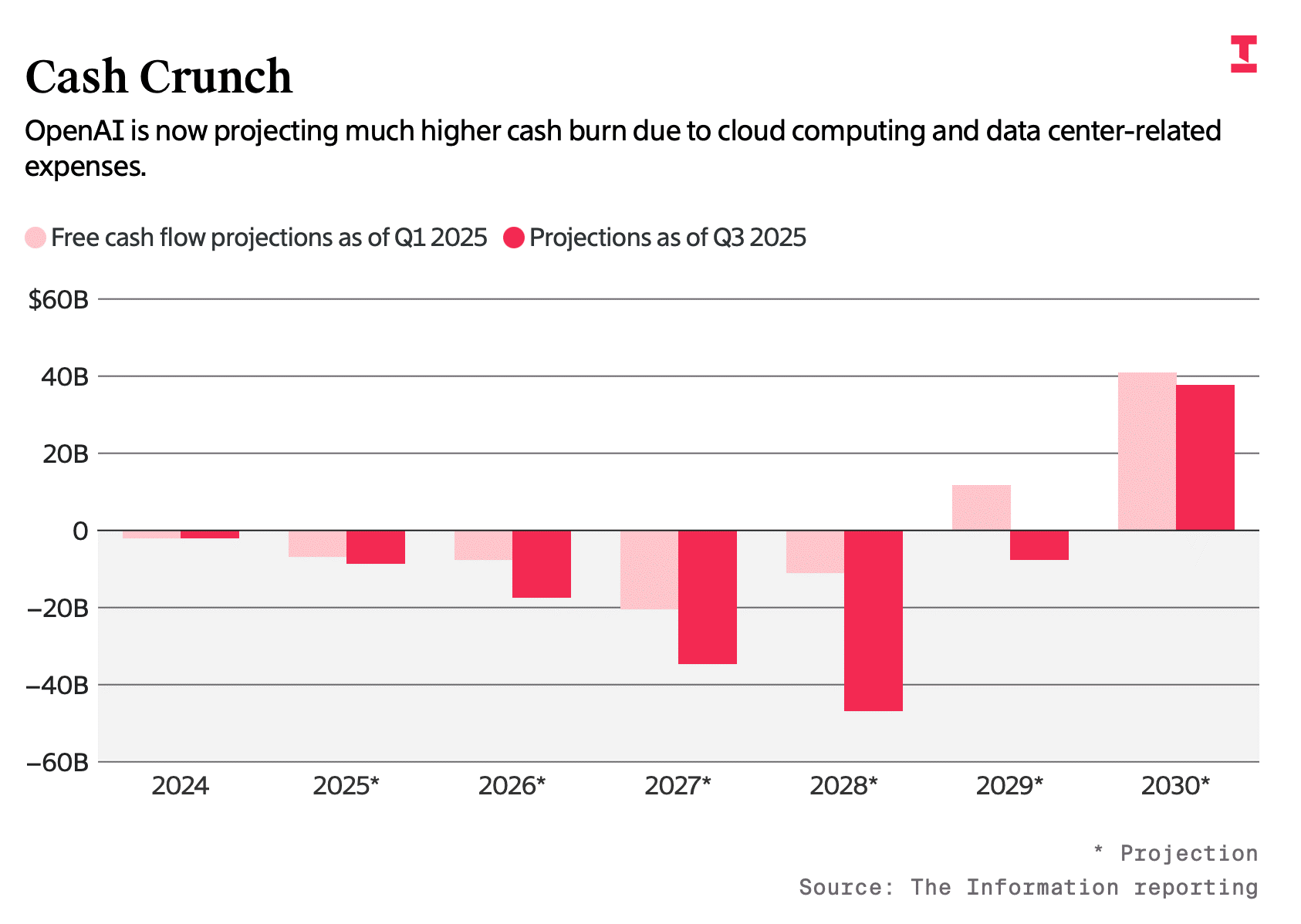

OpenAI has revised its financial forecast—and the numbers are staggering. The company now expects to burn through $115 billion through 2029, up from a previous estimate of $35 billion. The spike is driven by surging infrastructure and model training costs as it tries to keep pace with its own AI ambitions.

On the upside, revenue from ChatGPT is growing faster than expected, with projections of $13 billion this year and nearly $200 billion by 2030. Investors don’t seem fazed: OpenAI’s valuation is nearing $500 billion, and capital continues to flood in.

Betting the Company on Infrastructure

OpenAI is no longer content renting the cloud—it wants to own it. After becoming one of the largest cloud customers on Earth, the company is now investing nearly $100 billion to build its own data centers and design custom server chips.

The goal is to control long-term costs and turn infrastructure into a profit center, much like Amazon did with AWS. But unlike AWS, OpenAI will be doing this while developing next-gen models and managing explosive user growth—essentially flying the plane while building the runway.

ChatGPT as the Golden Goose

ChatGPT is now OpenAI’s financial engine. The company expects $10 billion in revenue from the chatbot alone this year, up from $8 billion previously, and a staggering $90 billion annually by 2030. What’s driving that optimism? A belief that users will not only pay to chat, but also shop, search, and transact within the product.

OpenAI expects $110 billion in revenue between 2026 and 2030 just from monetizing free users—via affiliate fees, commerce, or possibly advertising. These services are projected to earn 80–85% gross margins, putting them in Facebook territory. If even part of that holds true, ChatGPT could become one of the most lucrative consumer products in tech history.

Repositioning the Product Stack

While ChatGPT forecasts soar, OpenAI has quietly cut $5 billion from API revenue projections and trimmed expectations for its “agents” products by $26 billion over five years.

That suggests a strategic refocus: instead of growing a sprawling product suite, OpenAI is doubling down on ChatGPT as the main interface for both individual and enterprise users.

Why It Matters:

OpenAI is no longer just the most hyped AI company—it’s the most capital-intensive startup in history. The eye-popping $115 billion burn forecast is unprecedented, yet investors from SoftBank to Thrive are still bidding up its stock.

Its trajectory mirrors a Big Tech firm, but its for-profit unit remains controlled by a nonprofit, and its ability to eventually IPO is complicated by contracts with Microsoft and legal disputes with Elon Musk.

Still, if OpenAI can convert users into revenue with Facebook-like margins while controlling infrastructure costs through vertical integration, the bet could pay off. But if not, $115 billion may become the most expensive science experiment in startup history.